Corporate Governance

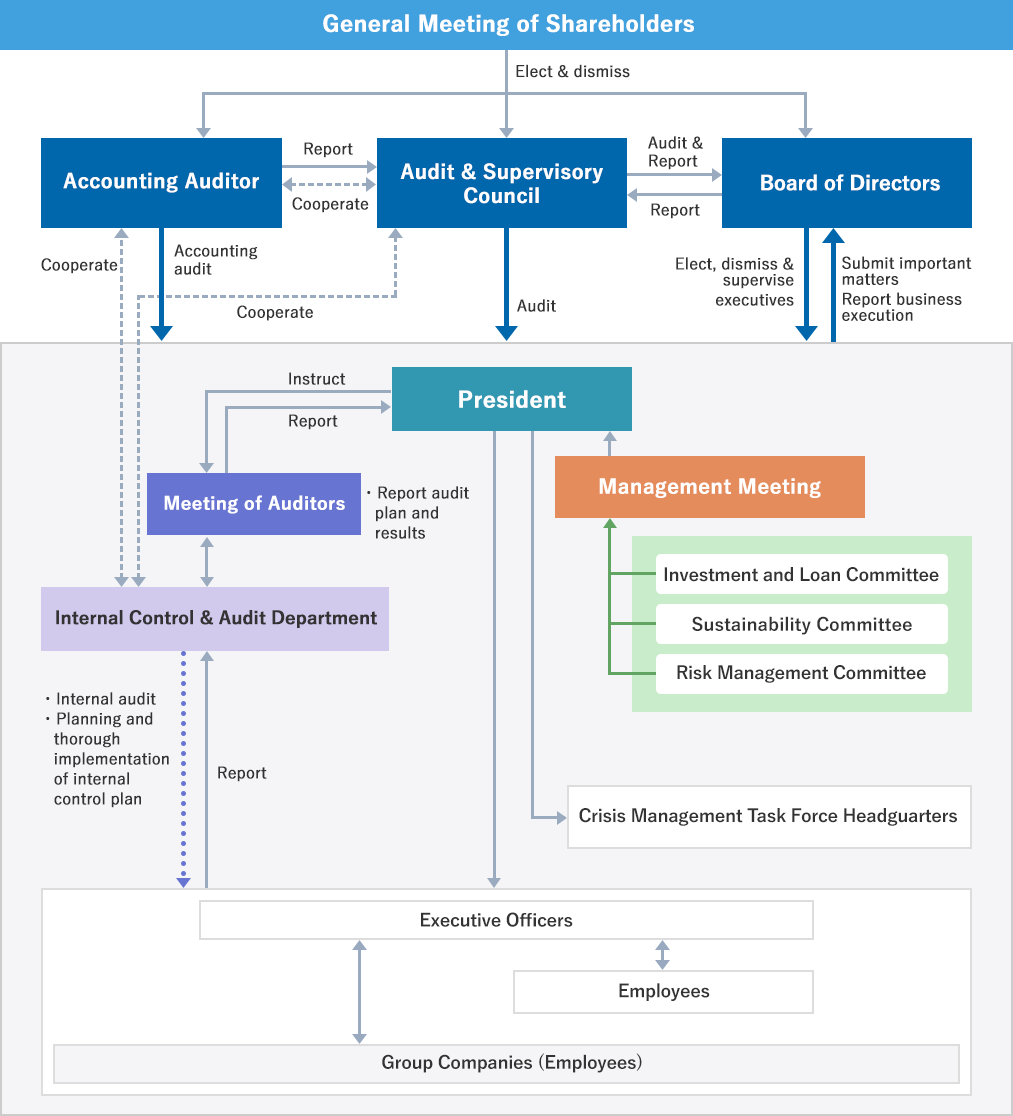

Through reliable operation of its Basic Policy about Internal Control System, NST further enforces its corporate governance, ensures “compliance with laws and ordinances,” “reliability of financial reporting,” and “effectiveness and efficiency of operations,” and aims to improve it continuously.

NST has also adopted the Executive Officer System and aims at the efficient operation of the Board of Directors by separating the function of decision-making and supervision and the function of business execution, and has adopted a system to promptly cope with changes in the management environment.

Board of Directors

The Board of Directors is composed of all Directors and in general meets once a month. It decides important matters regarding company management, and supervises the execution of duties by the Directors.

Audit & Supervisory Board Members

In order to monitor and supervise the execution of duties by the Directors, the Audit & Supervisory Board Members attend important meetings of the Board of Directors, the Management Meeting, and other committees, and can view all drafts and reports in the database. As necessary, they request reports from the Directors and others, and state their opinions.

Management Meeting

The Management Meeting is composed of Directors who also serve as Executive Officers or Advisors, and in general meets twice a month. It discusses important operational policies and other important matters related to company management, and advises the President. The meetings are also attended by Audit & Supervisory Board Members, who can state their opinions.

Establishment of committees within the governance system

In order to further promote corporate governance, we have established the Investment and Loan Committee, Sustainability Committee, and Risk Management Committee.

Internal audits

The Internal Control & Audit Department is established as the department for internal controls and auditing, and regularly conducts audits of effectiveness, efficiency, and other matters in the operations of NST and its subsidiaries in Japan and overseas.

Important risks and other matters identified at the audits are reported at suitable times to the Risk Management Committee. For the company-wide risks identified by the Risk Management Committee, the all functional divisions provide support and instruction for improvements, and check the implementation status through internal audits.

As programs for ensuring the effectiveness of internal audits, the audit results are reported to the full-time Audit & Supervisory Board Members at the Audit Liaison Meeting that is held each month, and the annual audit plan, audit results, and other matters are reported to the Directors at the Meeting of Auditors that is held twice annually.

Sustainability (corporate governance, etc.) promotion system