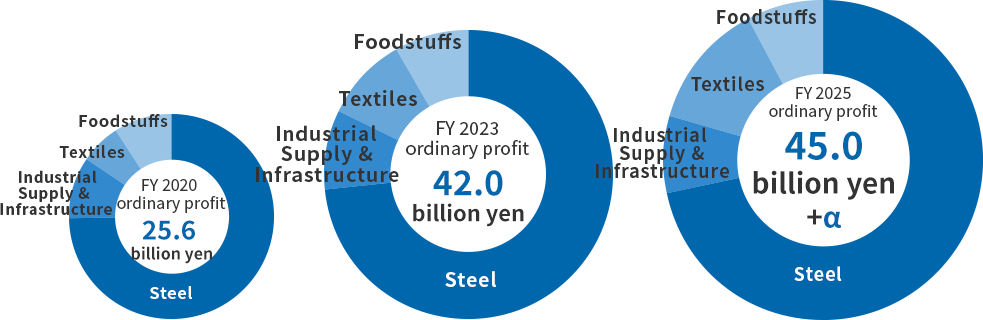

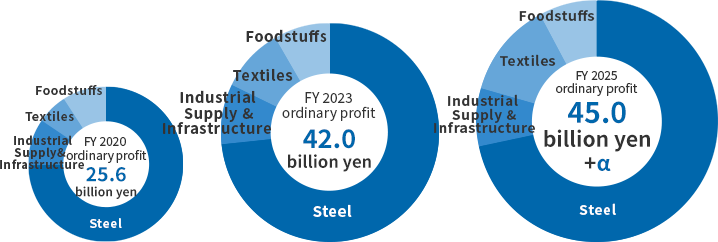

Medium- to Long-Term Management Plan 2025

1. Implementation measures and Financial Targets

Implementation measures

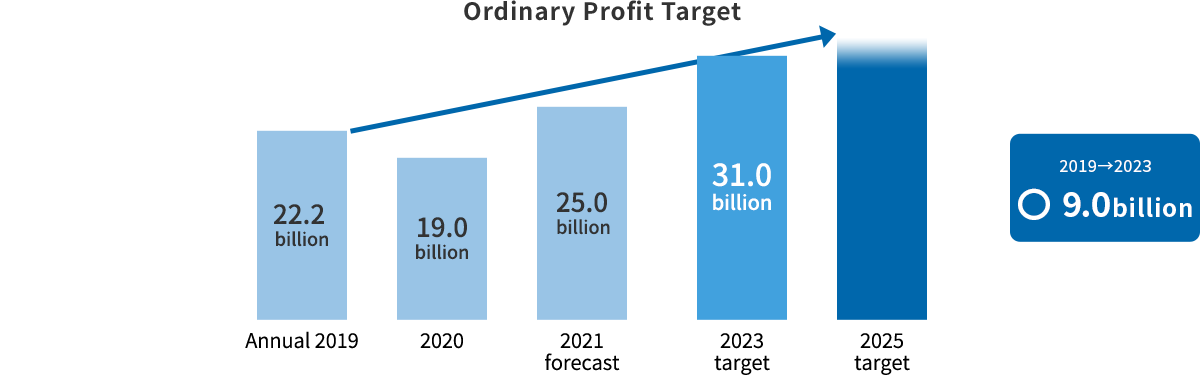

FY 2019 ordinary profit

33.2 billion yen

Expected decline

× 12.0 billion yen

1Building a robust corporate structure by implementing measures to strengthen the business foundation

- Drastic improvement of value-added productivity and reduction of general and administrative expenses

- Reorganization, integration, and elimination of the Group's manufacturing and sales bases

Effect expected by FY 2023

〇 10.0 billion yen

2Realizing sustainable increases in profit by promoting growth strategies

- Acquire new business demand

- Promotion of global strategies for deepening and expanding overseas business

- Expansion of sales and improvement of profitability by collaborating with major users, strengthening distribution and processing, and providing solutions

- Promotion of M&A and alliance strategies that lead to improved distribution efficiency and new business creation

- Promotion of DX strategies

Effect expected by FY 2023

〇 11.0 billion yen

3Adopting ESG management

- Contribution to a carbon-free society and environmental conservation

- Contribution to national and regional development

- Contribution to a recycling-based society and sustainable living

- Optimization of integrated supply chains (use of information and technology)

- Utilization of diverse human resources (nurturing people, making good use of people, and valuing people)

- Management based on reliability and trust

FY 2023 target Ordinary profit

42.0 billion yen

Progress on strategic policies and actions to improve fixed expenses

〇 3.0 billion yen+α

FY 2025 target Ordinary profit

45.0

billion yen

+α

Financial Targets

| Medium- to Long-Term Management Plan | ||

|---|---|---|

| FY 2023 targets | FY 2025 targets | |

| Consolidated ordinary profit | 42.0 billion yen | 45.0 billion yen +α |

| Profit attributable to owners of parent | 26.0 billion yen | 28.0 billion yen +α |

2. Measures by Division

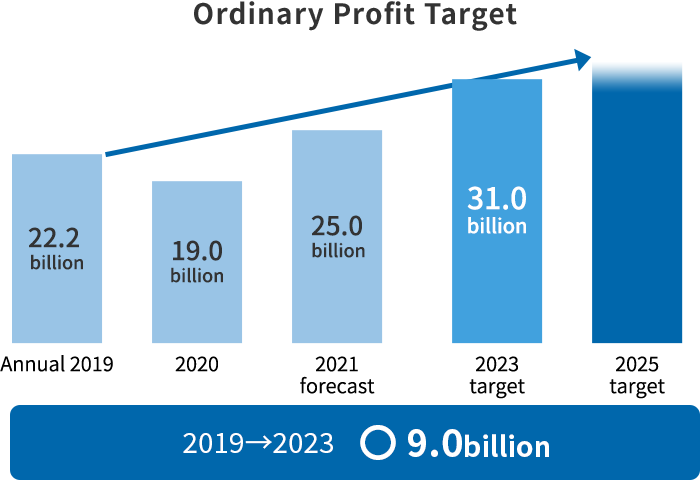

Steel Division

- Environmental change

- × 7.5billion

- Strengthen business foundation

- 〇 7.5billion

- Growth strategy

- 〇 9.0billion

Adopting ESG management

Main growth strategies

- Capture environmental and other new demand

- Implement global strategies such as strengthening efforts to become an “integrated

member” in developing markets overseas - Expand sales and improve profitability by coordinating with major users

- Promote M&A and alliance strategy

- Reform steel distribution via DX strategy

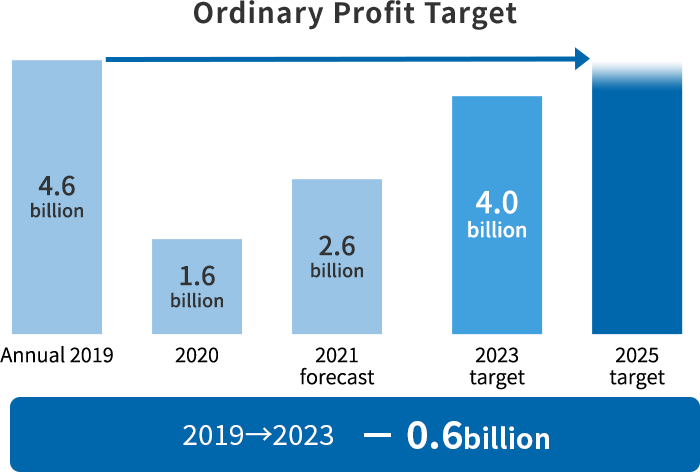

Industrial Supply & Infrastructure Division

- Environmental change

- × 1.6billion

- Strengthen business foundation

- 〇 1.0billion

- Growth strategy

- 〇 600million

Adopting ESG management

Main growth strategies

- Promote multi-material technology (Steel Business Division collaboration)

- Enhance responses to growing global demand for aluminum

- Expand global development of head rest parts business

- Expand exports of railway track maintenance equipment and kitchen automation

equipment - Expand rooftop solar power generation business

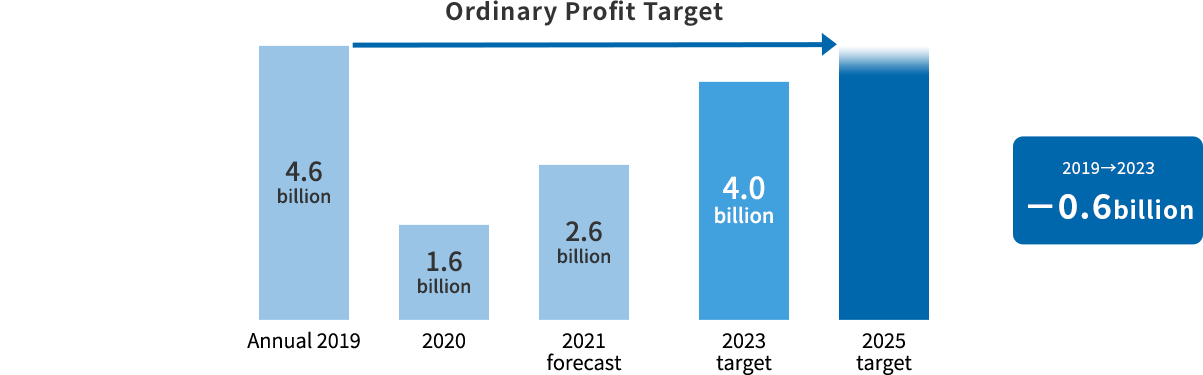

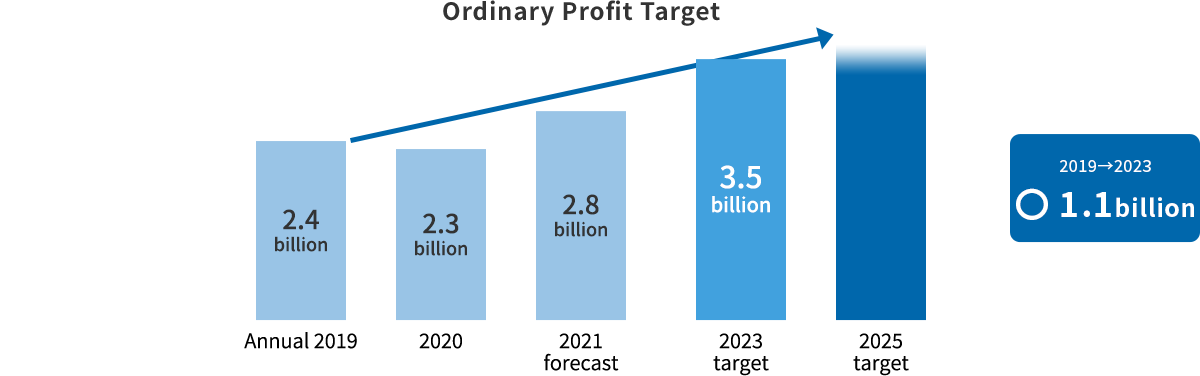

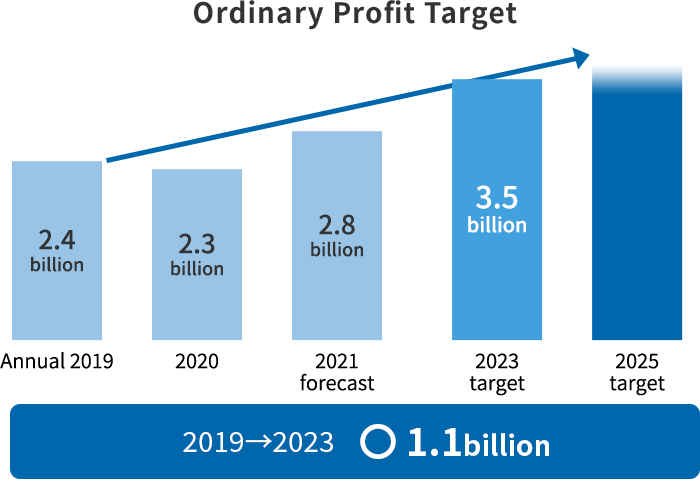

Textiles Division

- Environmental change

- × 3.0billion

- Strengthen business foundation

- 〇 1.7billion

- Growth strategy

- 〇 700million

Adopting ESG management

Main growth strategies

- Cultivate growth users and fields (lifestyle market, etc.)

- Expand global transactions (Europe, China, etc.)

- Cultivate new businesses (for mail-order/e-commerce businesses, fitness, etc.)

- Expand products that address social needs for ethical consumption, etc.

(recycled/upcycled products, etc.)

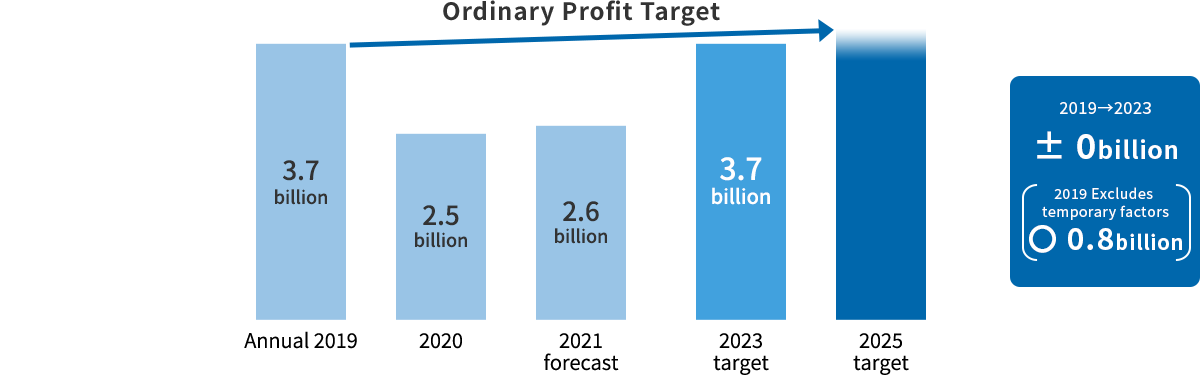

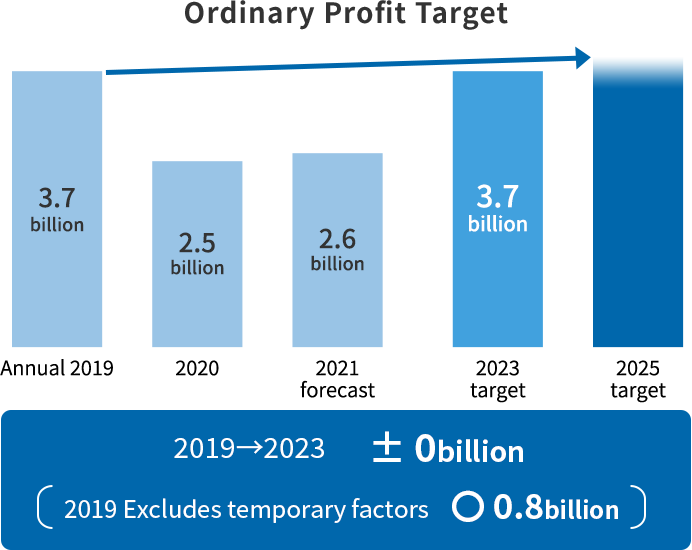

Foodstuffs Division

- Environmental change

- ± 0billion

- Strengthen business foundation

- 〇 400million

- Growth strategy

- 〇 700million

Adopting ESG management

Main growth strategies

- Expand sales of plant-based meat alternatives and antibiotic/hormone-free pork

- Cultivate Southeast Asian markets

- Strengthen volume sales and takeout sales

- Enhance value chain through M&A

3. Financial Strategies and Return to Shareholders

Financial Strategies

| FY 2020 result | Medium- to Long-Term Management Plan | ||

|---|---|---|---|

| FY 2023 | FY 2025 | ||

| ROE | 6.5% | 9 - 10% | |

| ROIC | 3.9% | Around 6% | |

| Net D/C ratio | 0.95x | 1.0x or less | |

Return to Shareholders

The Company will set a target for a consolidated dividend payout ratio of 30% or higher and

strive to increase shareholder returns in line with stable profit growth.

4. Medium- to Long-Term environmental targets

Rolling out activities for reducing CO2 emissions Group-wide

| Subjects | NST and consolidated subsidiaries in Japan and overseas | |

|---|---|---|

| Established target | FY 2030 | Reduce CO2 emissions by 30% compared to FY 2018 |

| FY 2050 | Achieve carbon neautrality | |